In his influential 2014 article “The Case for Reparations,” scholar Ta-Nehisi Coates writes, “An honest assessment of America’s relationship to the black family reveals the country to be not its nurturer but its destroyer. And this destruction did not end with slavery.” [2] The case of blockbusting in Baltimore from 1944 to 1968 shows how this ongoing attack on Black families operated on the local level for Black Baltimoreans a century after Emancipation. These histories show how American racial capitalism exacerbated racial wealth disparities in the mid-twentieth century. For the purposes of this article, American racial capitalism refers to the system through which race has played a defining and compounding role in wealth creation and distribution throughout the history of the United States. This started with slavery and will continue until society rises to disrupt it. Two features of how blockbusting unfolded in Baltimore are particularly illuminative for understanding these inequities. Firstly, the segregation of credit excluded Black Baltimoreans from the lending and financial opportunities available to their white counterparts, pushing them to operate through exploitative white intermediaries. [3] Secondly, white Baltimoreans refused to fathom the possibility of integrated living, fueling white flight and panic on a mass scale. [4] Present-day discussions about reparations for centuries of Black oppression by and in the United States should also consider blockbusting, a systemic continuation of the structural inequities induced by American racial slavery. Baltimore’s 1944-1968 blockbusting histories illuminate the deep relevance of these intergenerational harms, providing a strong local complement to national calls for reparations.

It is important to establish a working definition of blockbusting in the Baltimore context. A blend of the definitions of two scholars provides great explanatory capacity. Historian W. Edward Orser defines blockbusting as “the intentional action of a real estate operative to settle an African American household in an all-white neighborhood for the purpose of provoking white flight in order to make excessive profits by buying low from those who fled and selling high to those who sought access to new housing opportunities.” [5] This covers the operational developments but does not address the structural exploitation. Borrowing from public historian Mary Rizzo’s explanation of blockbusting, it is important to add that, “Agents also profited by selling the homes at inflated prices through shady contracts to black buyers with no other options.” [6] The reason for the lack of financial options for Black Baltimoreans was exclusion from banking and lending opportunities. In turn, Black residents were willing to pay what historian Emily Lieb rightfully describes as “a preposterous markup” to gain access to desirable housing in previously white neighborhoods. [7]

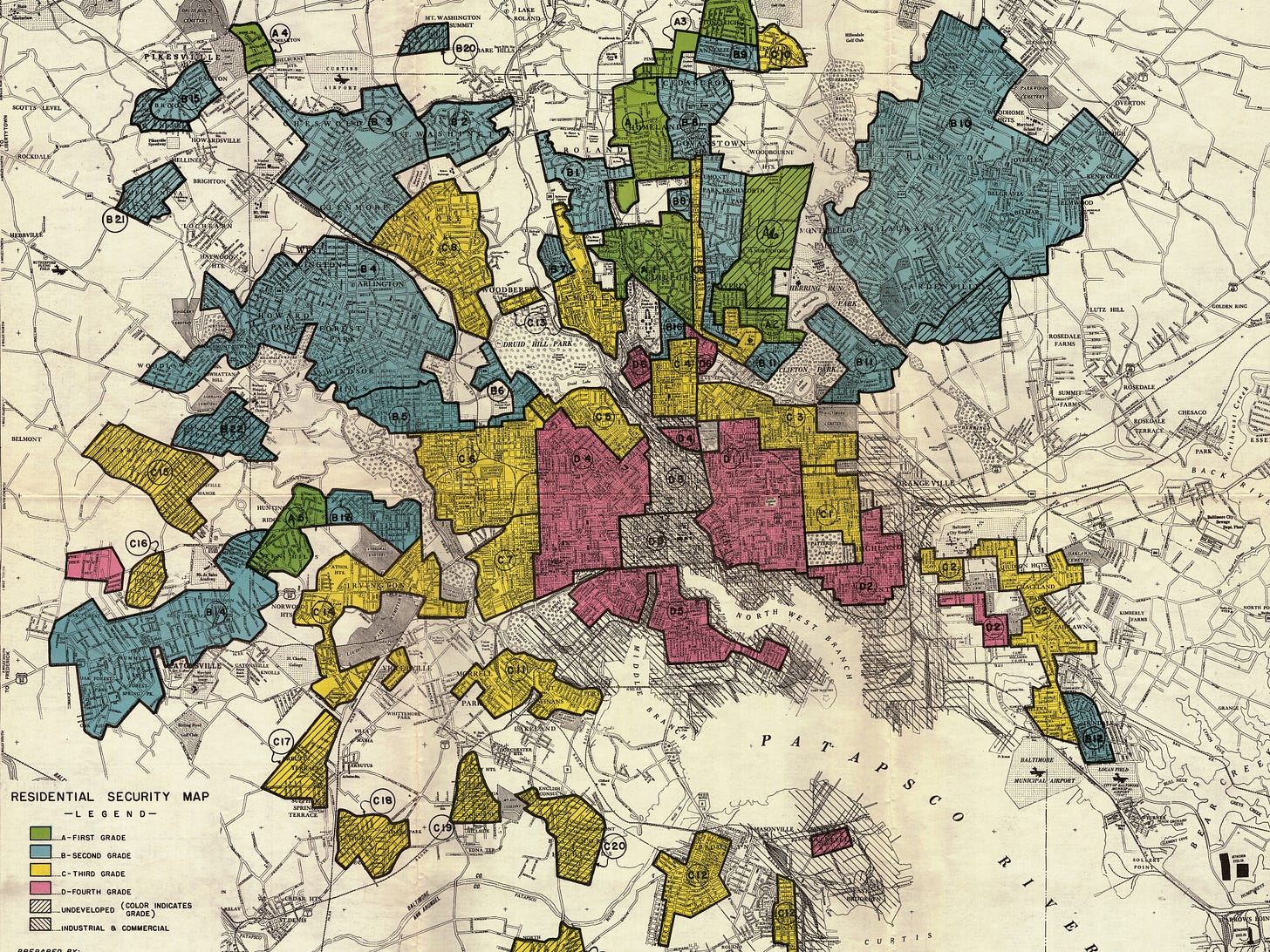

In the blockbusting era, major financial institutions were willing to loan large amounts of money to white real estate speculators but many refused to do business with Black Americans. This segregation of banking and lending was a twentieth-century manifestation of American racial capitalism. To use Coates’s phrase, “Plunder in the past made plunder in the present efficient.” [8] Intergenerational structural financial inequities meant that the continuation of such inequities was profitable. The banks and real estate speculators made money from these transactions at the expense of the financial stability of Black Americans. The lack of federal financial regulations enabled this exploitation. As legal scholar Richard Rothstein argues, “Although banks and savings and loan associations typically refused to issue mortgages to ordinary homeowners in African American or in integrated neighborhoods, the same institutions issued mortgages to blockbusters in these neighborhoods, all with the approval of federal bank regulators.” [9] Federal policies enforced these inequities by redlining Baltimore’s Black neighborhoods, rendering them hazardous for lending. [10] Federal redlining limited the neighborhoods where Black Baltimoreans could purchase homes for reasonable prices, necessitating working through intermediaries. [11] When white speculators then entered exploitative rent contracts with Black neighborhood newcomers, the systemic segregation of finance was extended into individual business relationships.

Blockbusters used land-installment contracts to translate the leverage granted to them by the segregation of finance into contractual agreements with Black Baltimoreans. This relationship also racialized the risk factors involved. Indeed, as writer Antero Pietila points out, “For the seller, the risks were minimal. The title remained in his name until the purchaser accrued enough equity, usually 40 percent, to qualify for a mortgage. Often that day never came. If a contract buyer failed to make payments on time, the seller would simply evict the deadbeat [sic] and offer the property to the next family.” In these arrangements, the buyer never actually purchased the house or encountered a deed of sale. Instead, blockbusters continued asking for weekly installment payments in pursuit of an arbitrary installment endpoint which they set themselves. [12] The case of prominent Baltimore blockbuster Morris Goldseker exemplifies these relationships. Historian Sherry H. Olson crunched the numbers and came up with the math behind Goldseker’s formula. She writes, “Goldseker himself bought seventeen hundred homes in Baltimore in the ‘60s. On the average he bought a home for $7,500 and resold it for $13,000, a markup of $5,500.” As part of the land-installment contract, “Goldseker’s practice… was to create a ground rent, worth perhaps $1,500. A savings and loan company provided the family with a mortgage for $8,500, while Goldseker held a second mortgage of $4,500.” The buyer thus had to pay off a double mortgage, and Goldseker took home the profits. [13]

Blockbusting relied on panic-induced white flight rooted in white refusal to consider the possibility of integrated living. As Orser writes, “At the individual level, the refusal of white residents to consider the possibility of residential integration made their own racism” a fundamental component of blockbusting. [14] When a Black family moved into a previously predominantly white neighborhood, individual white families determined the neighborhood was doomed and packed their bags accordingly. Orser concludes from his oral history interviews about blockbusting that, “The words chosen by the interviewees in their retrospection reflect the insulated culture of a white community that could not entertain the possibility that African American presence meant anything other than invasion.” [15] When white residents fled, blockbusters stepped in to reap the profits and neighborhoods went through rapid racial transition. Historian Kenneth D. Durr writes of Baltimore’s Fulton Avenue case in 1945 that even in this the first major case of Baltimore blockbusting, “it only took a few sales to convince Fulton Avenue whites to abandon the neighborhood.” [16] White families put their own interests over those of their neighbors and sought to evacuate with minimal financial loss. Luckily for them, blockbusting speculators were more than ready to buy.

The emphasis on white flight in Baltimore blockbusting histories tends to overlook Black Baltimorean experiences. It is important to amplify these experiences to avoid the whitewashing of blockbusting. Black families who purchased homes from blockbusting realtors eagerly seized the long-overdue availability of upgraded housing. Decades of suppressed opportunities for Black housing investment built up the demand for such opportunities. [17] As Orser emphasizes, “During the 1940s Baltimore City’s African American population grew by more than 25 percent, while the boundaries of segregation expanded hardly at all, placing extreme stresses upon a limited, aging housing market.” [18] Black Baltimoreans with money to spend were restricted to impoverished sections of the city with large Black populations. [19] It makes sense that with the opening of new housing stock in previously white neighborhoods, the growing Black middle-class would invest. The expansion of job opportunities for Black Baltimoreans because of Baltimore’s booming World War II economy fueled this demand. [20] White intransigence further contributed to building pressures for Black residential expansion. [21] Blockbusters took advantage of the ensuing built-up pressures on both sides of Baltimore’s racial divide, while Black Baltimoreans worked hard to open up and access improved investment opportunities.

Expanding economic opportunities for Black Americans during and after World War II ran up against a financial and residential system designed to exclude Black success. White real estate speculators offered a way around the racial exclusion built into financial lending systems. In the process, speculators crafted exploitative contractual arrangements designed to take capital from Black buyers and turn it into white profit. Unwilling to consider integration, white residents swiftly sold and fled. The Baltimore blockbusting case shows how American racial capitalism is self-perpetuating. Investment capital and financial leverage are both tied to whiteness and to Black oppression. Allowing financial systems to operate without race-based social intervention enables the continuation of these cycles. This is why blockbusting is an illuminative Baltimore example of the need for reparations. It also shows the need for such compensation on both local and national levels. Federal redlining policy and the lack of local regulation of racialized real estate speculation both exacted intergenerational financial damage on Black communities. [22] In this regard, reparations are due to Black Baltimoreans from both local authorities and the federal government. When Congress passed the Civil Rights Act of 1968, fair housing protections received federal legislative backing. This legislation technically forbade blockbusting, but it was not all-encompassing. Abusive and racially discriminatory real estate and investment practices still exist, but are now less blatant. [23] For example, the relative lack of supermarkets and other fresh food retailers in some of Baltimore’s Black neighborhoods show how public and corporate investment remain racialized. [24] This example shows that reparations are not just owed to individual Black Baltimoreans, but also in the form of direct Black community investment.

[1] HOLC Division of Research & Statistics, “Residential Security Map of Baltimore Md.,” 1937, public domain, https://jscholarship.library.jhu.edu/handle/1774.2/32621.

[2] Ta-Nehisi Coates, “The Case for Reparations,” The Atlantic, June 2014, 55, https://mgaleg.maryland.gov/cmte_testimony/2020/hgo/4101_03102020_105922-720.pdf.

[3] Richard Rothstein, The Color of Law: A Forgotten History of How Our Government Segregated America (New York: Liveright Publishing, 2017), 98, https://archive.org/details/coloroflawforgot0000roth.

[4] W. Edward Orser, Blockbusting in Baltimore: The Edmondson Village Story (Lexington: The University Press of Kentucky, 1994), 5, https://core.ac.uk/download/pdf/232563948.pdf.

[5] Orser, Blockbusting in Baltimore, 4.

[6] Mary Rizzo, Come and Be Shocked: Baltimore Beyond John Waters and the Wire (Baltimore: Johns Hopkins University Press, 2020), 22, Kindle edition.

[7] Emily Lieb, “The ‘Baltimore Idea’ and the Cities It Built,” Southern Cultures 25, no. 2 (Summer 2019): 111, https://www.jstor.org/stable/26696401.

[8] Coates, “The Case for Reparations,” 64.

[9] Rothstein, The Color of Law, 98.

[10] Antero Pietila, Not in My Neighborhood: How Bigotry Shaped a Great American City (Chicago: Ivan R. Dee, 2010), 70, https://archive.org/details/notinmyneighborh0000piet.

[11] Rothstein, The Color of Law, 98-99.

[12] Pietila, Not in My Neighborhood, 99-103.

[13] Sherry H. Olson, Baltimore: The Building of an American City (Baltimore: The Johns Hopkins University Press, 1980), 379, https://archive.org/details/baltimorebuildin0000olso.

[14] Orser, Blockbusting in Baltimore, 5.

[15] Orser, Blockbusting in Baltimore, 99.

[16] Kenneth D. Durr, Behind the Backlash: White Working-Class Politics in Baltimore, 1940-1980 (Chapel Hill: The University of North Carolina Press, 2003), 86, https://archive.org/details/behindbacklashwh0000durr.

[17] Pietila, Not in My Neighborhood, 175.

[18] Orser, Blockbusting in Baltimore, 49.

[19] Orser, Blockbusting in Baltimore, 66.

[20] Orser, Blockbusting in Baltimore, 85.

[21] Pietila, Not in My Neighborhood, 54.

[22] Jonathan Pett, “The Persistent Effects of Redlining in Baltimore,” December 4, 2021, map created using ArcGIS software by Esri, https://storymaps.arcgis.com/stories/a2d055fecc4c4b259f10f19dd375e546.

[23] Orser, Blockbusting in Baltimore, 49.

[24] See Caitlin Misiaszek, Sarah Buzogany, and Holly Freishtat, “Baltimore City’s Food Environment: 2018 Report,” January 2018, Johns Hopkins Center for a Livable Future, https://clf.jhsph.edu/sites/default/files/2019-01/baltimore-city-food-environment-2018-report.pdf; Reuben Green, “Baltimore City’s food deserts: a civil rights leaders’ call to action,” the AFRO, January 19, 2023, https://afro.com/baltimore-citys-food-deserts-a-civil-rights-leaders-call-to-action/; Alissa Zhu, “We went shopping in a food desert where there is little access to healthy food. Here’s what we found,” Baltimore Banner, November 17, 2022, updated December 20, 2022, https://www.thebaltimorebanner.com/culture/food-drink/food-desert-grocery-shopping-H3LPQOZDARD6VNVIXSZET5OEUU/.